All you need to know on your reno loan for your dream home!

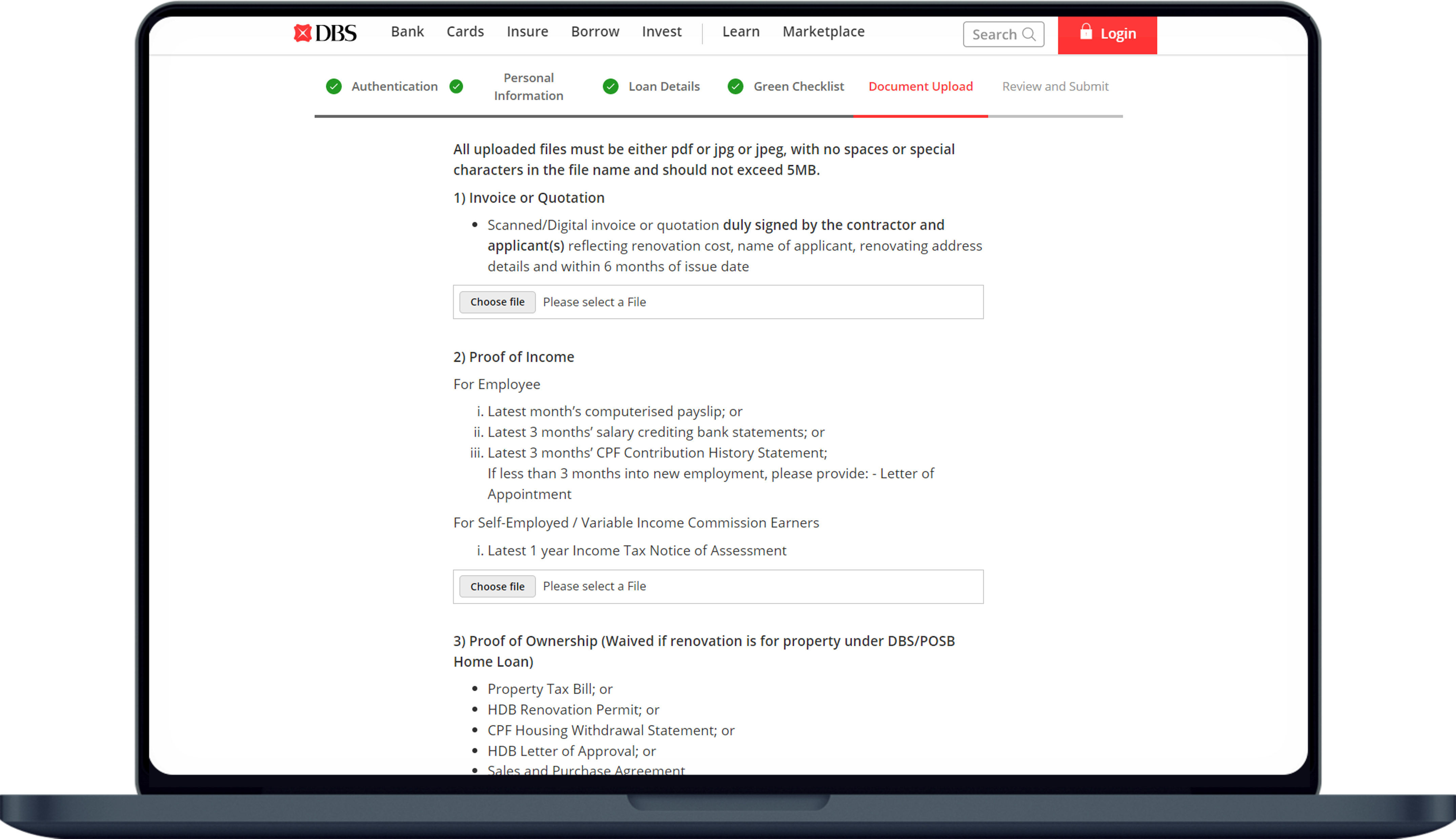

Prepare the following items to be submitted along with your application:

You will require a DBS/POSB deposit account to service your loan. If you do not have one, learn more on how to Open an Account with us before submitting your Renovation Loan application.

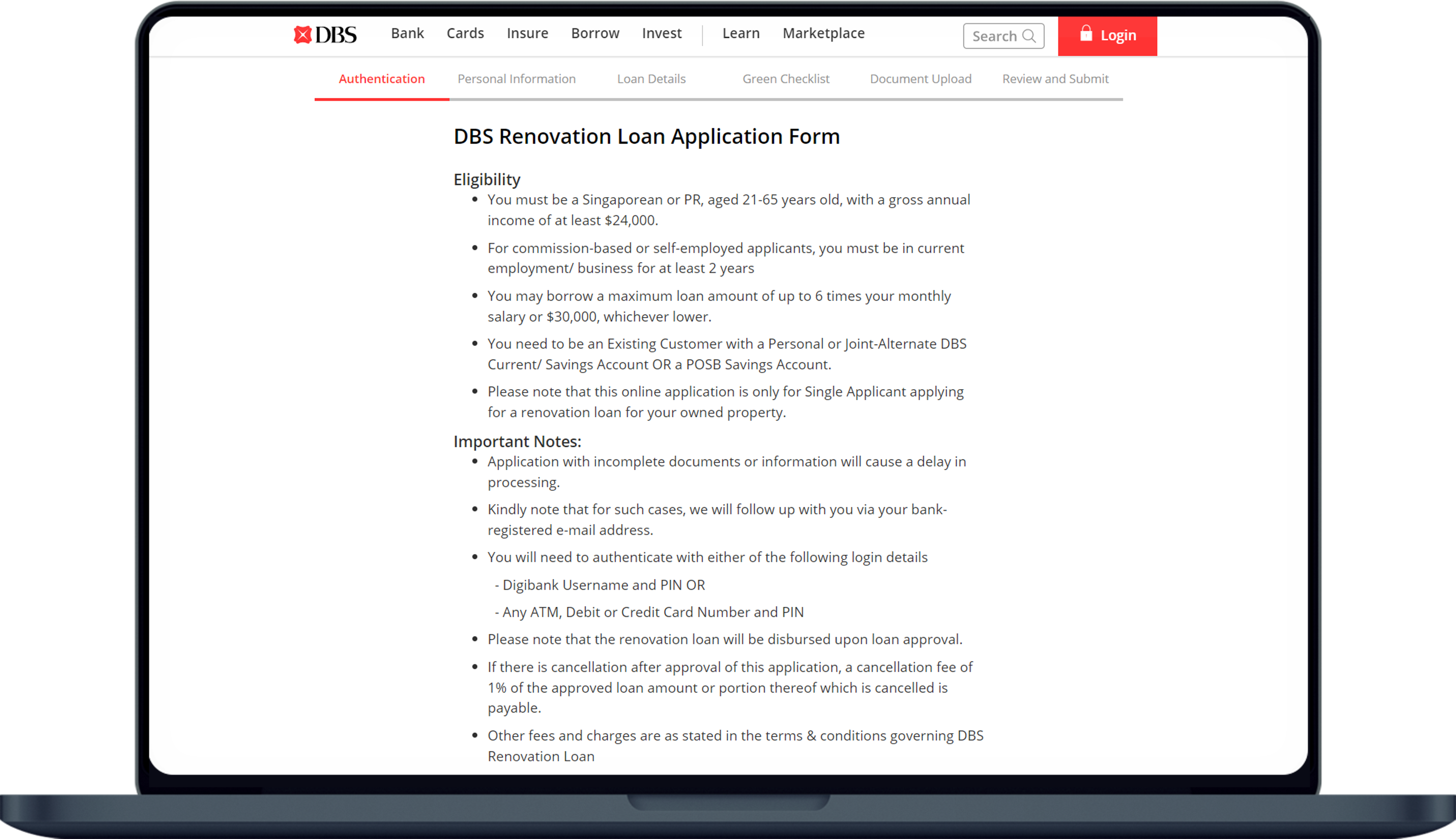

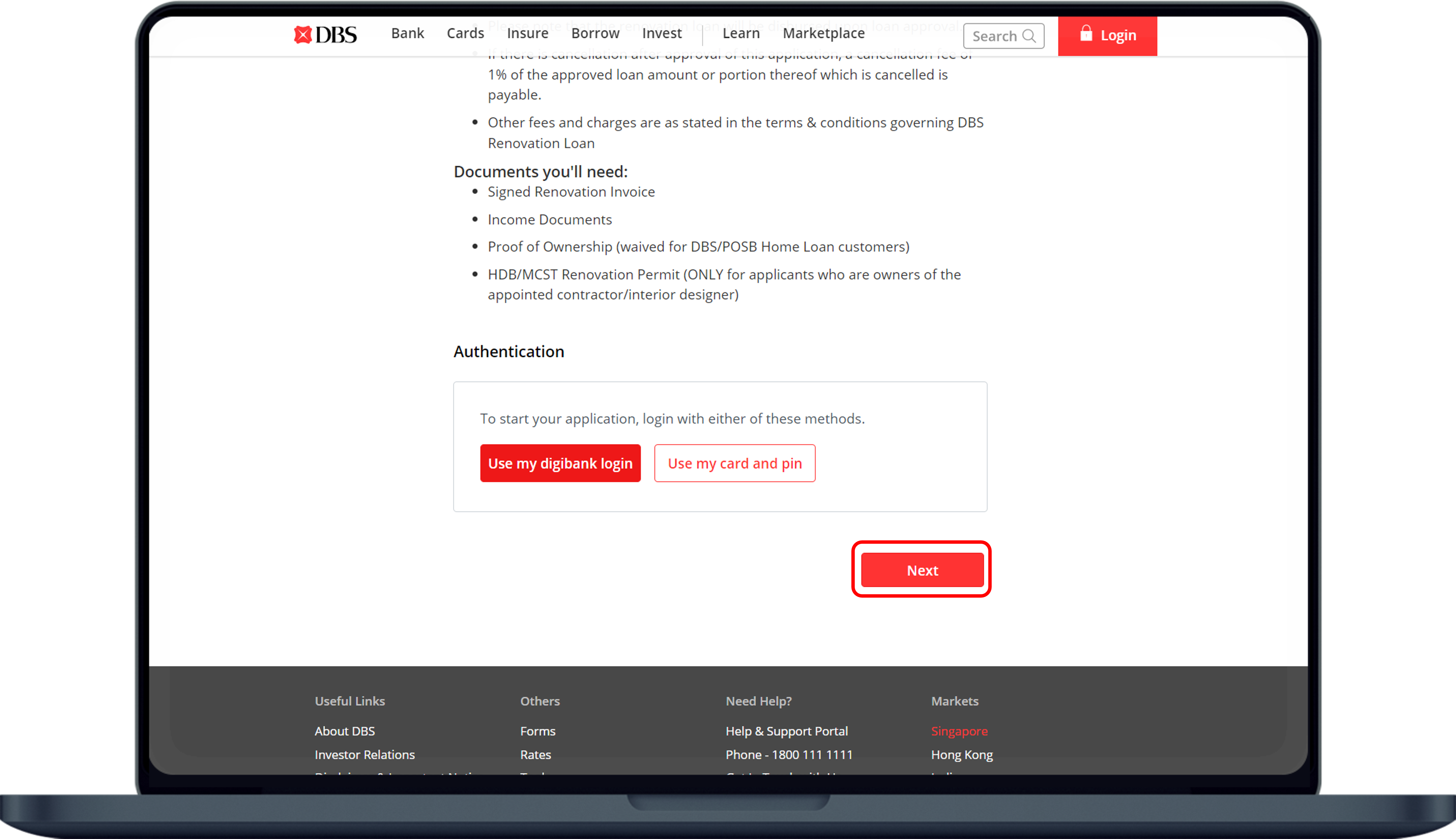

Step 1

Launch our Renovation Loan Online Application Form and read through the Eligibility, Important Notes and Documents you’ll need sections.

Step 2

Complete the Authentication Process using either your digibank Login or Card & PIN . Click Next to proceed.

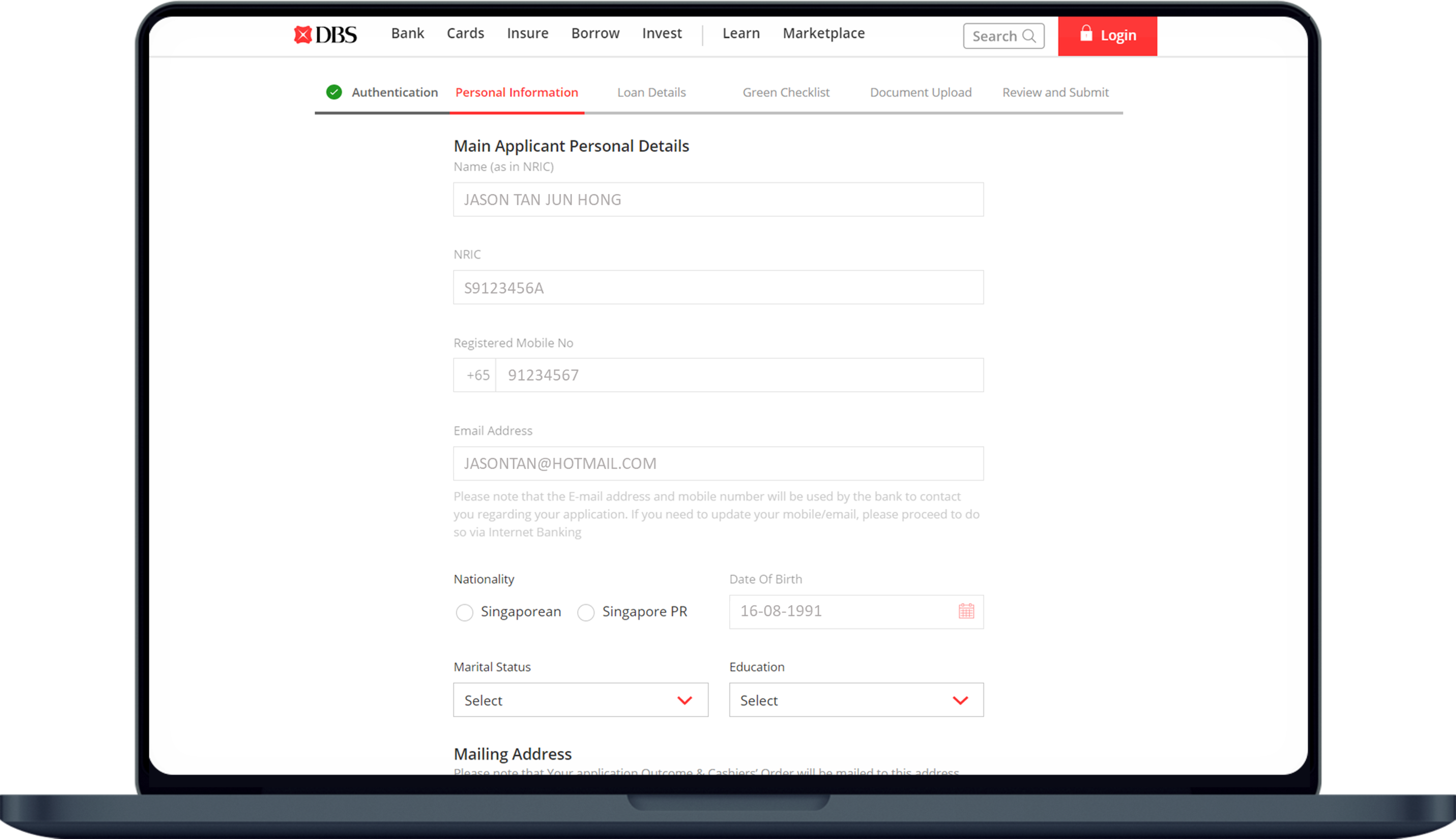

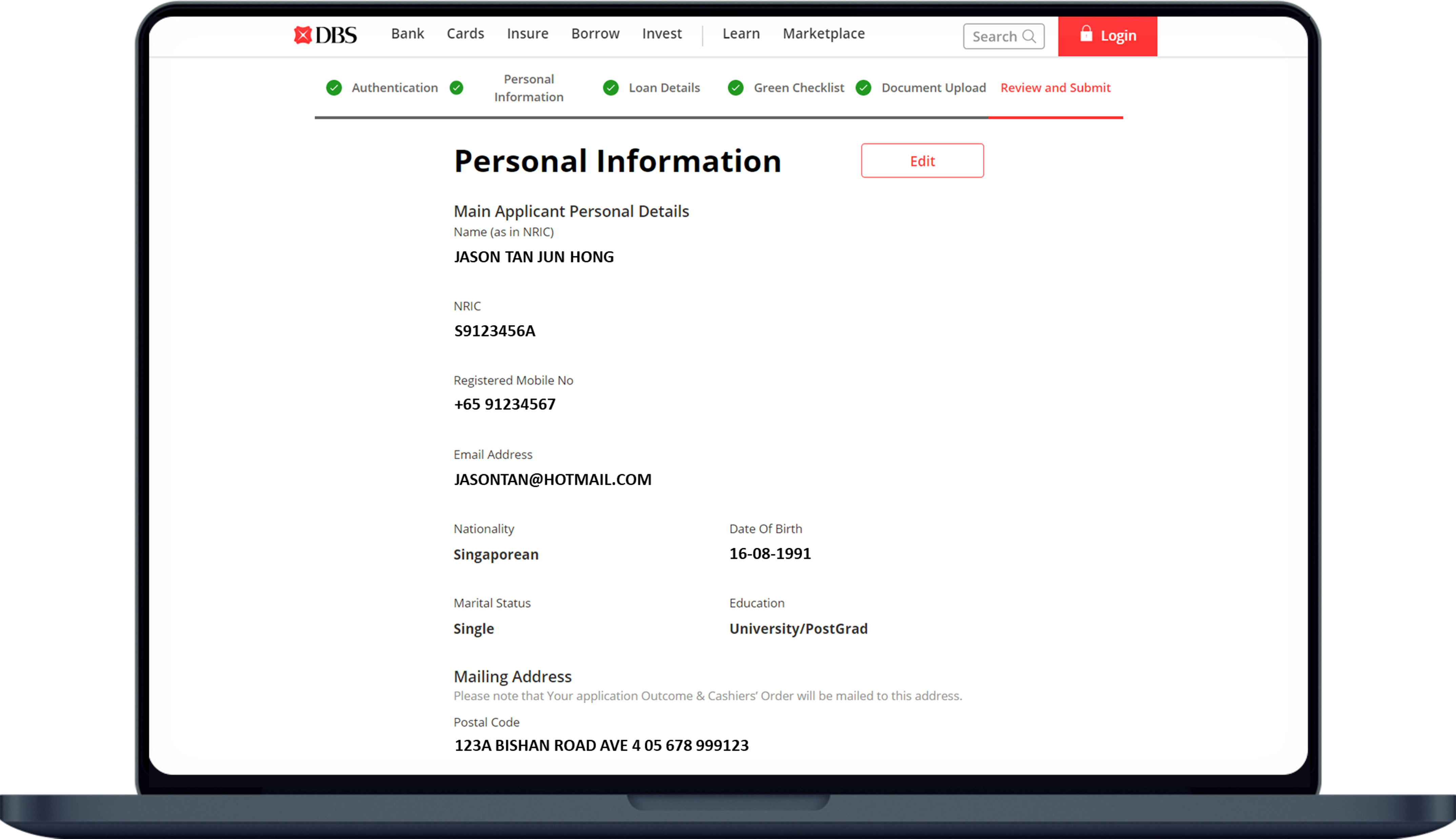

Step 3a

Verify that your Personal Details with the bank is up to date.

If you need to update your details, you may do so via digibank.

Select your Nationality , Marital Status and Education .

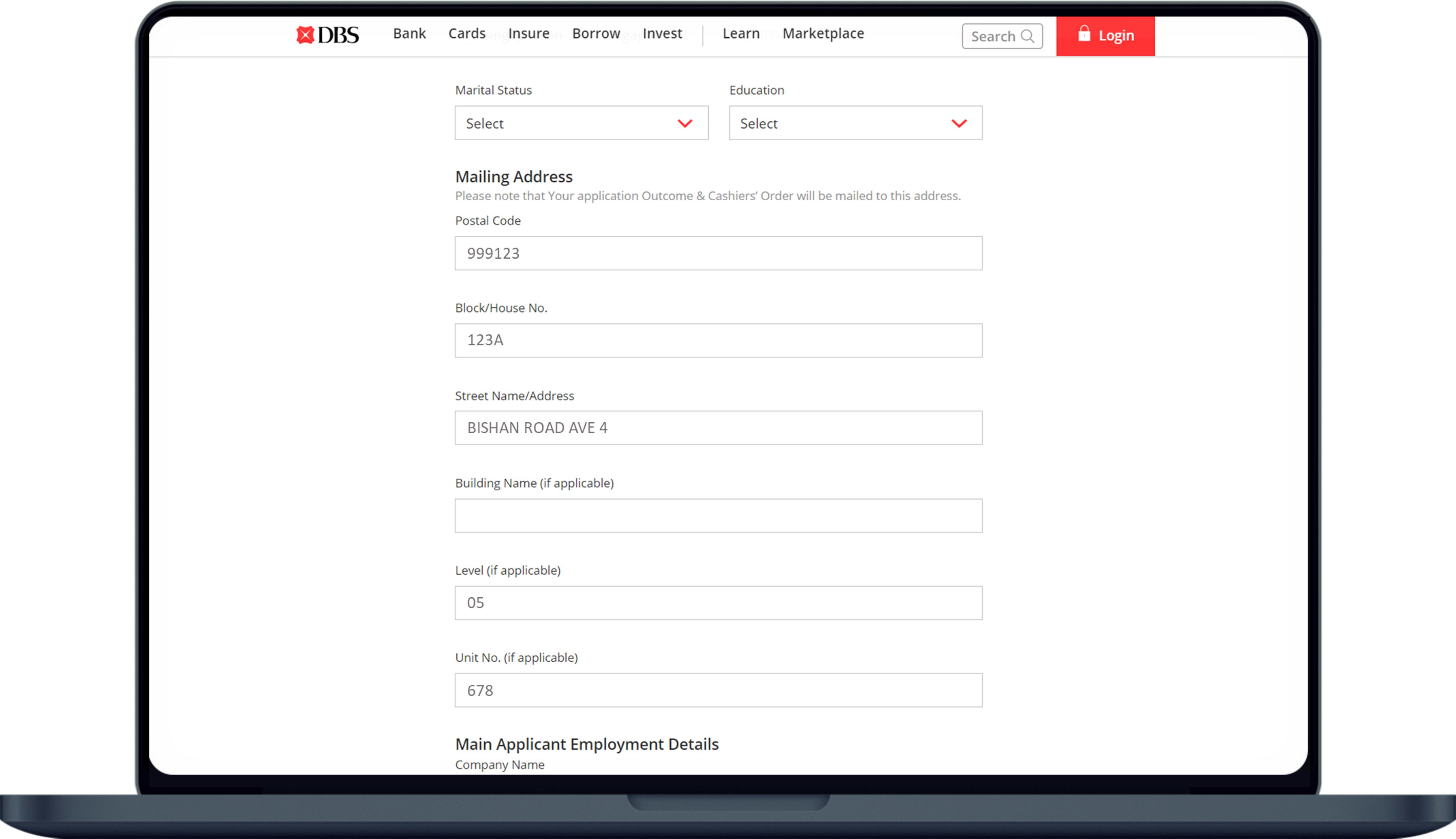

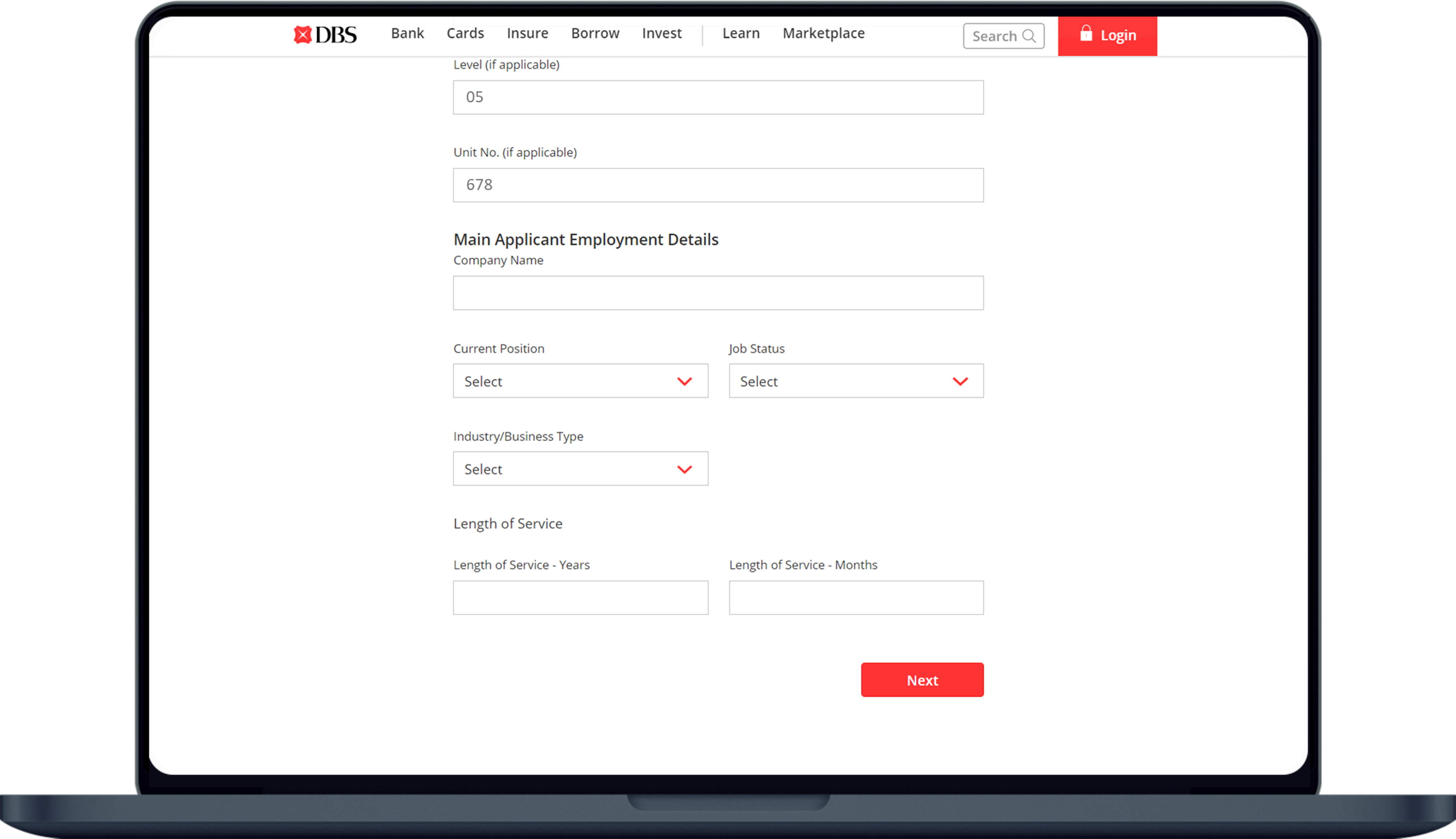

Step 3b

Check that your Mailing Address with the bank is up to date.

If you need to make any changes, you may edit the fields accordingly.

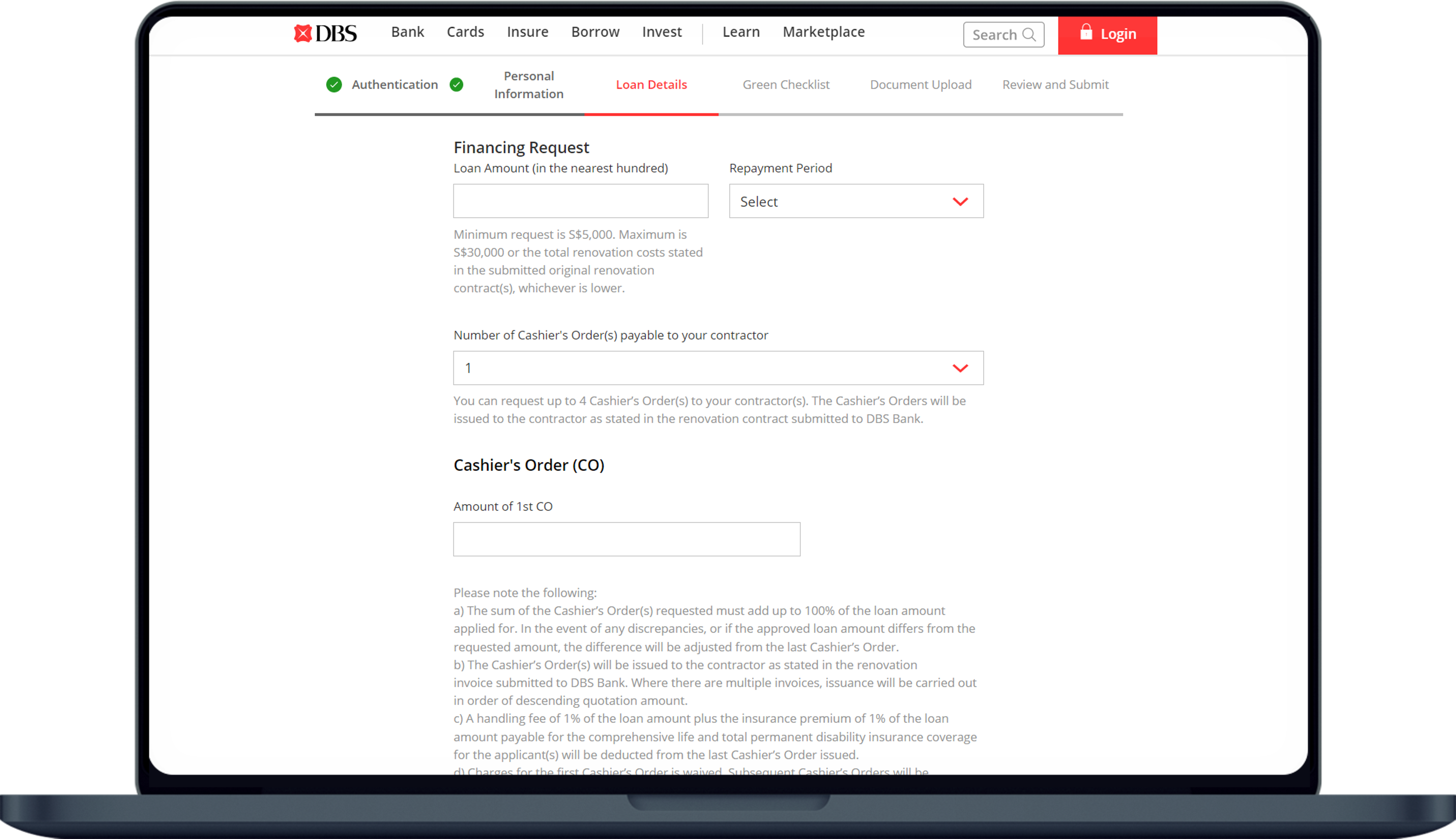

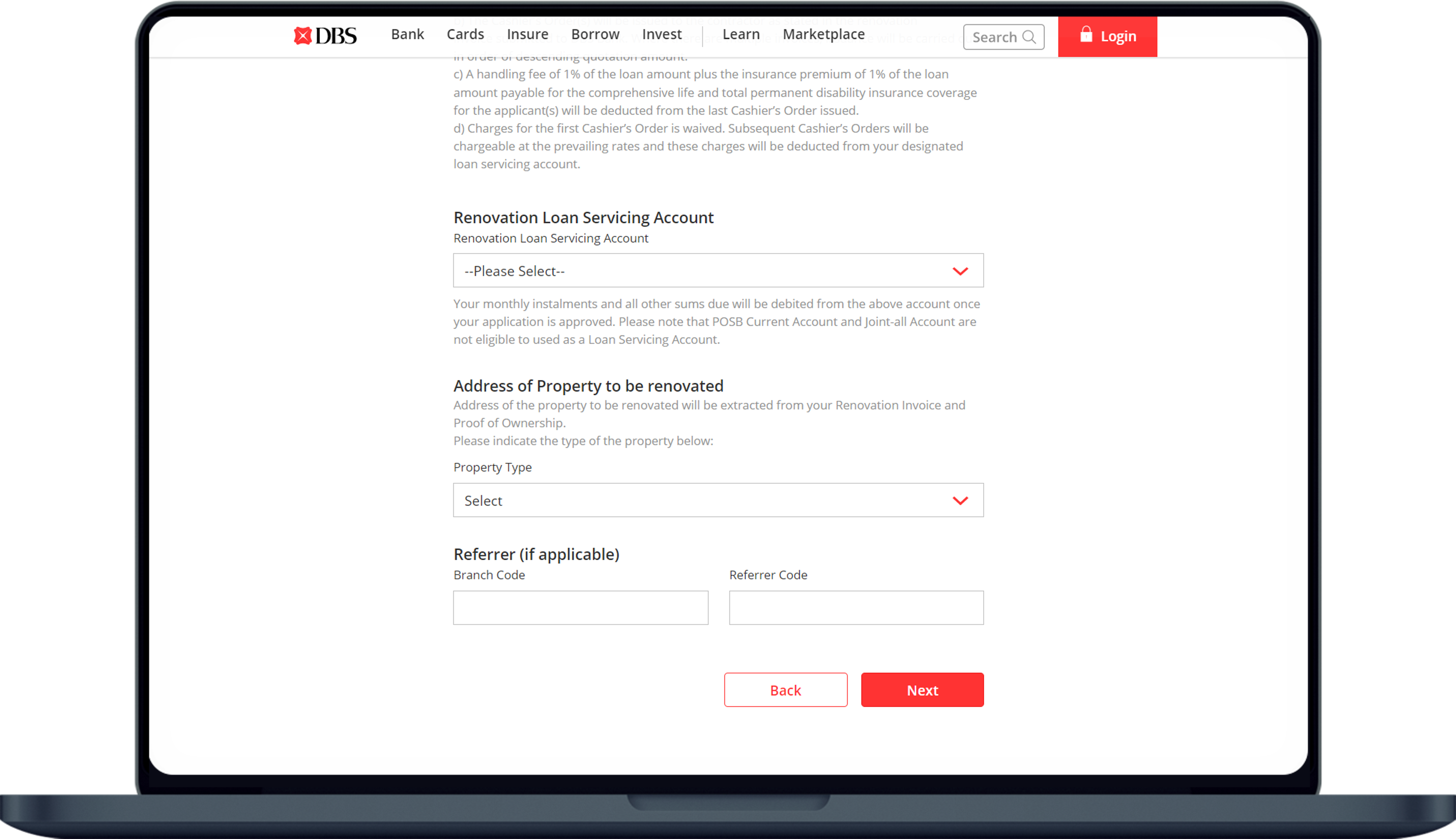

Step 4b

Select your Renovation Loan Servicing Account .

If there are no valid account(s) available for selection, click here to apply.

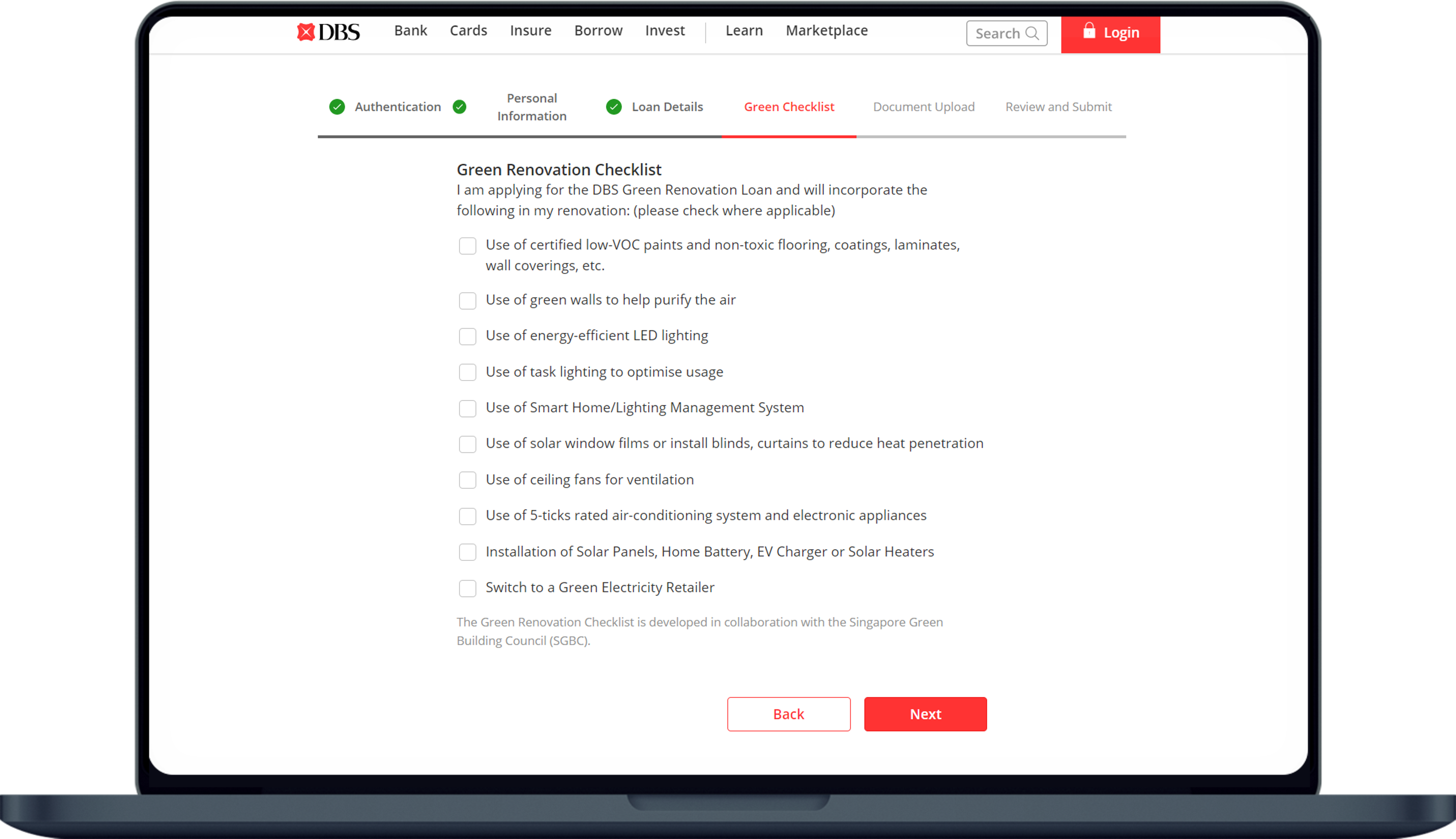

Step 5

Check the Green Renovation Checklist (where applicable) if you are applying for the DBS Green Renovation Loan.

Click Next to proceed.

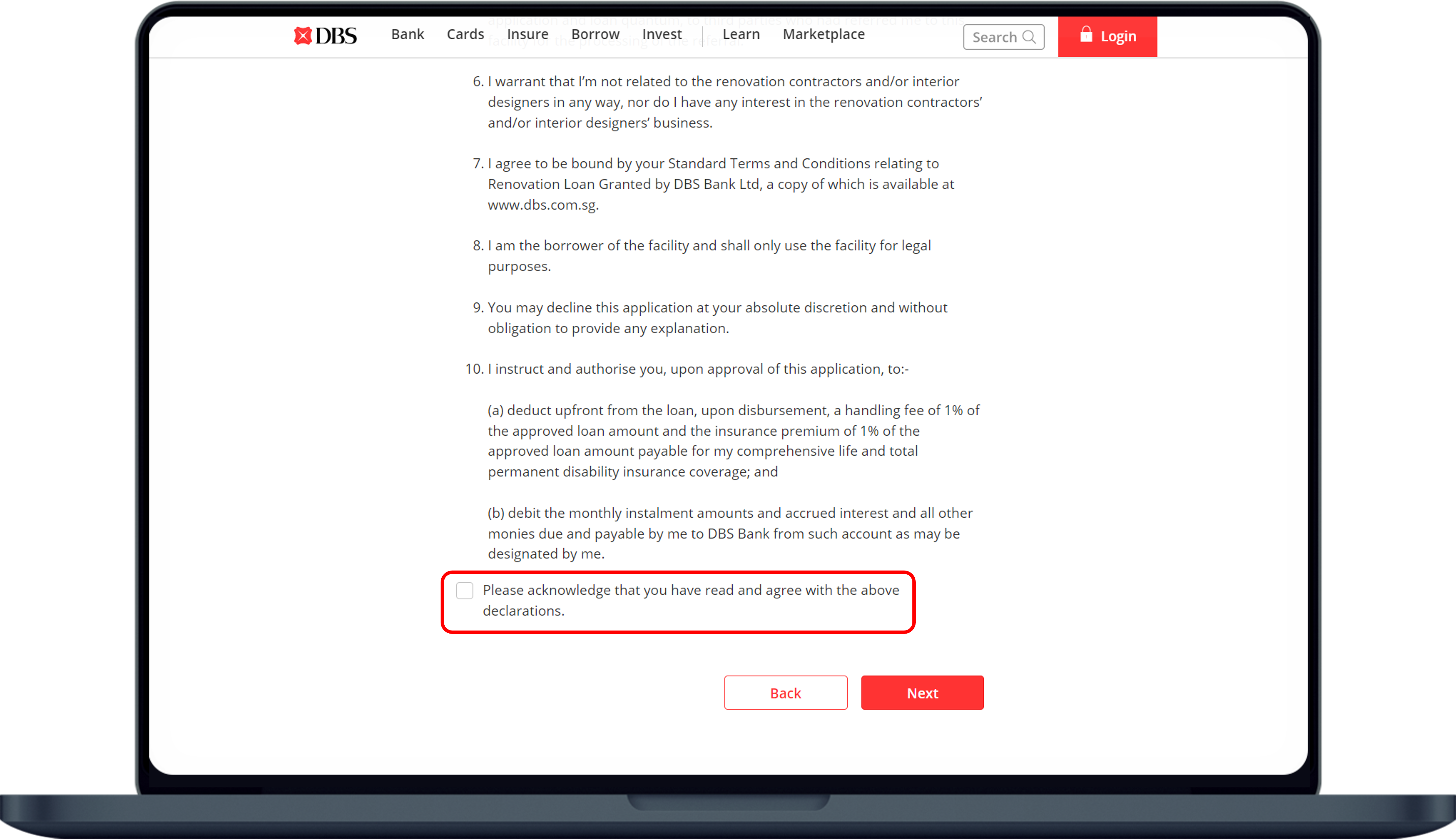

Step 7a

Review your application. If you need to make any changes, click Edit . After making the changes, click Save .

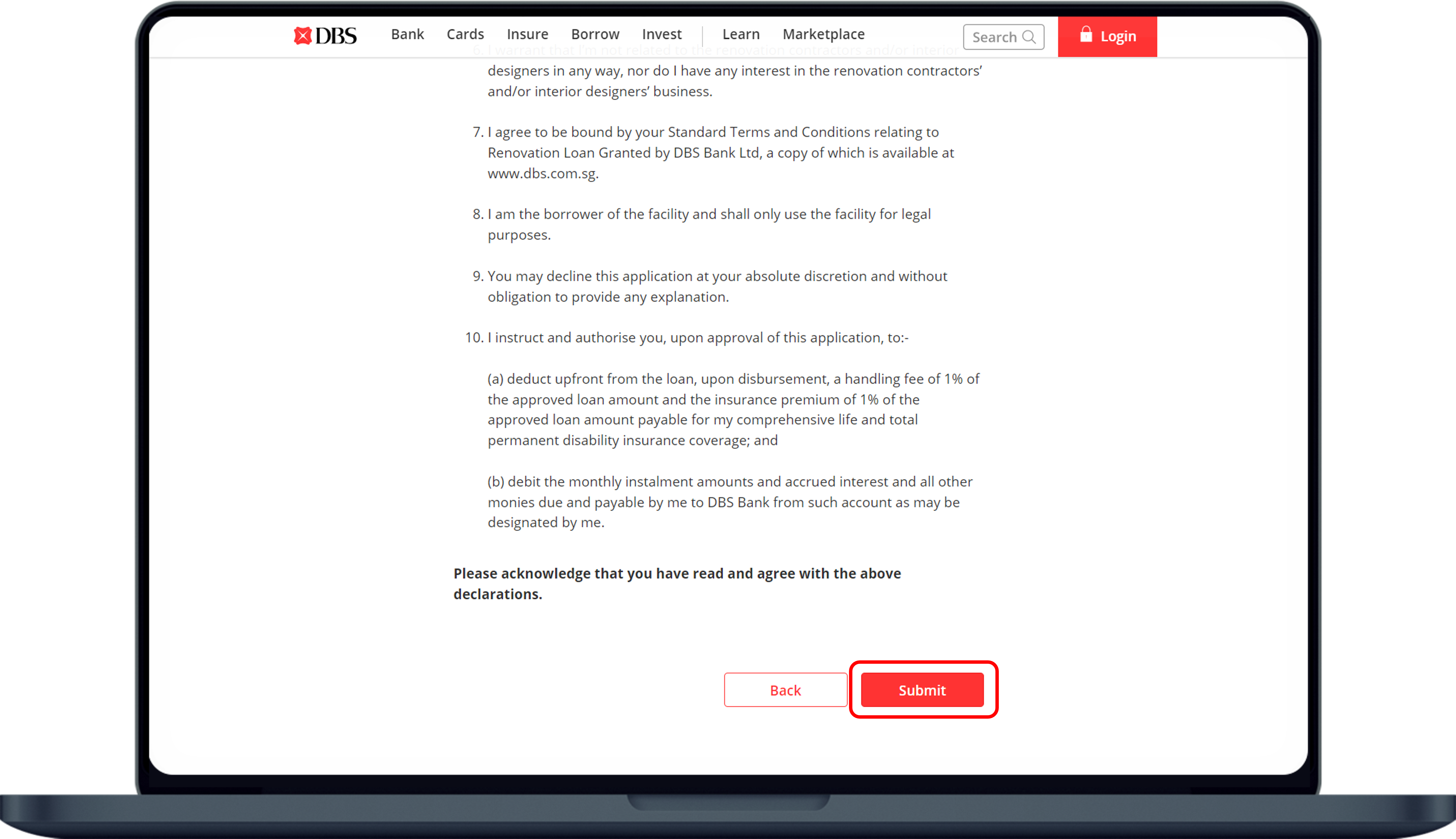

Step 8

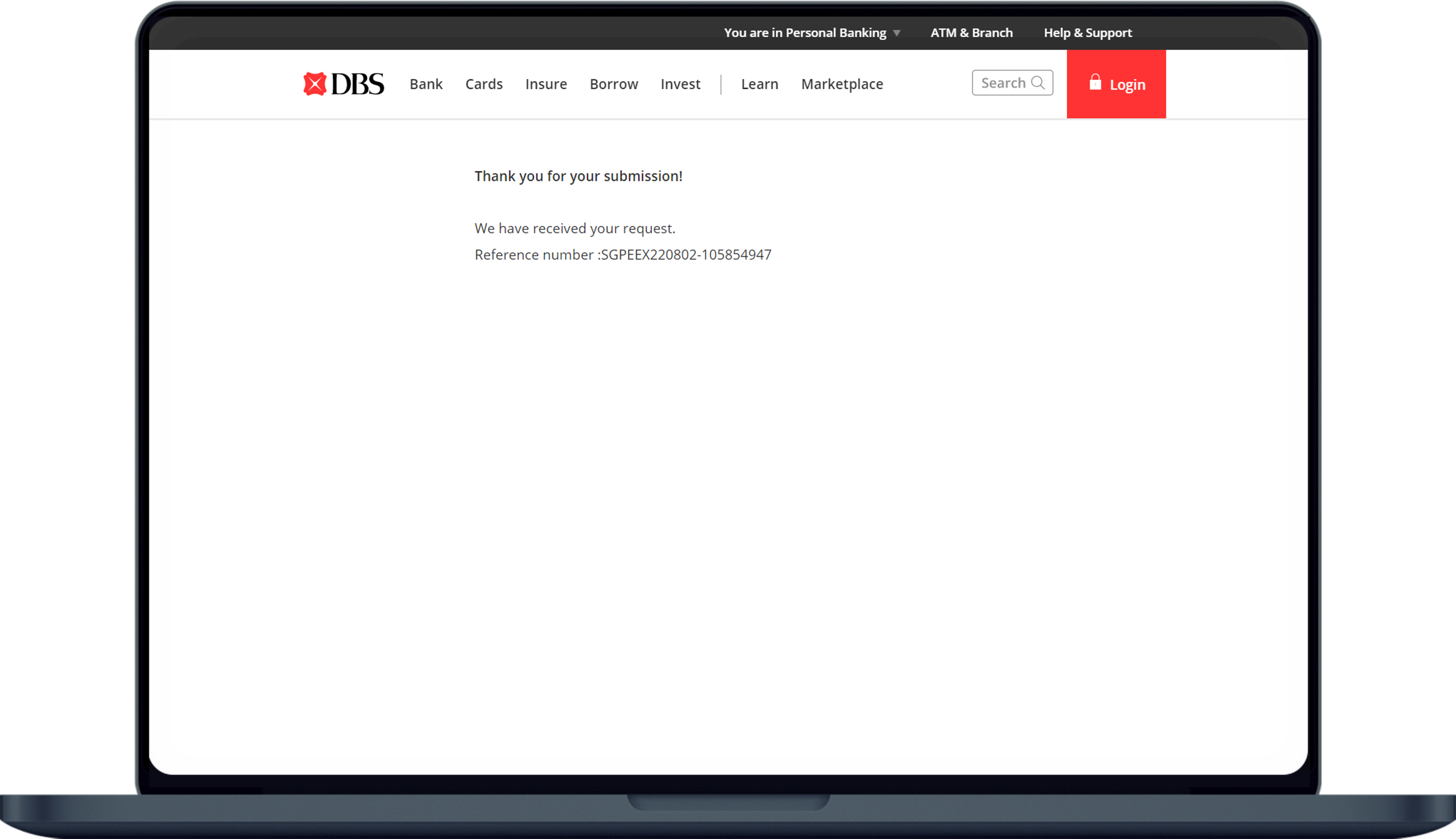

Your request has been submitted successfully and you will receive a confirmation email.

The application outcome and related documentations will be sent to your preferred mailing address within 7 working days .

![]()

File Name: No spaces or special characters

Image File Type: jpeg, pdf, or png file extension

Image Size Limit: Up to 5MB per document

You may borrow up to 6 times of your monthly income or S$30,000, whichever is lower. Please note that this is also subjected to approval based on your credit eligibility.

Main Applicant: Minimum income of S$24,000 per annum

Joint Applicant: Minimum Income of S$12,000 per annum (Main Applicant’s parent, spouse, child or sibling)

The lower monthly income (up to 12 times) of the two applicants will be used to compute the loan amount in a joint application. Please note that the maximum loan amount that will be considered is S$30,000.

For example:

If your monthly income is S$4,000 and the joint applicant’s monthly income is S$1,500, you can borrow up to a maximum of S$18,000 (S$1500 x 12).

Renovation loan is an unsecured loan as there is no collateral involved.

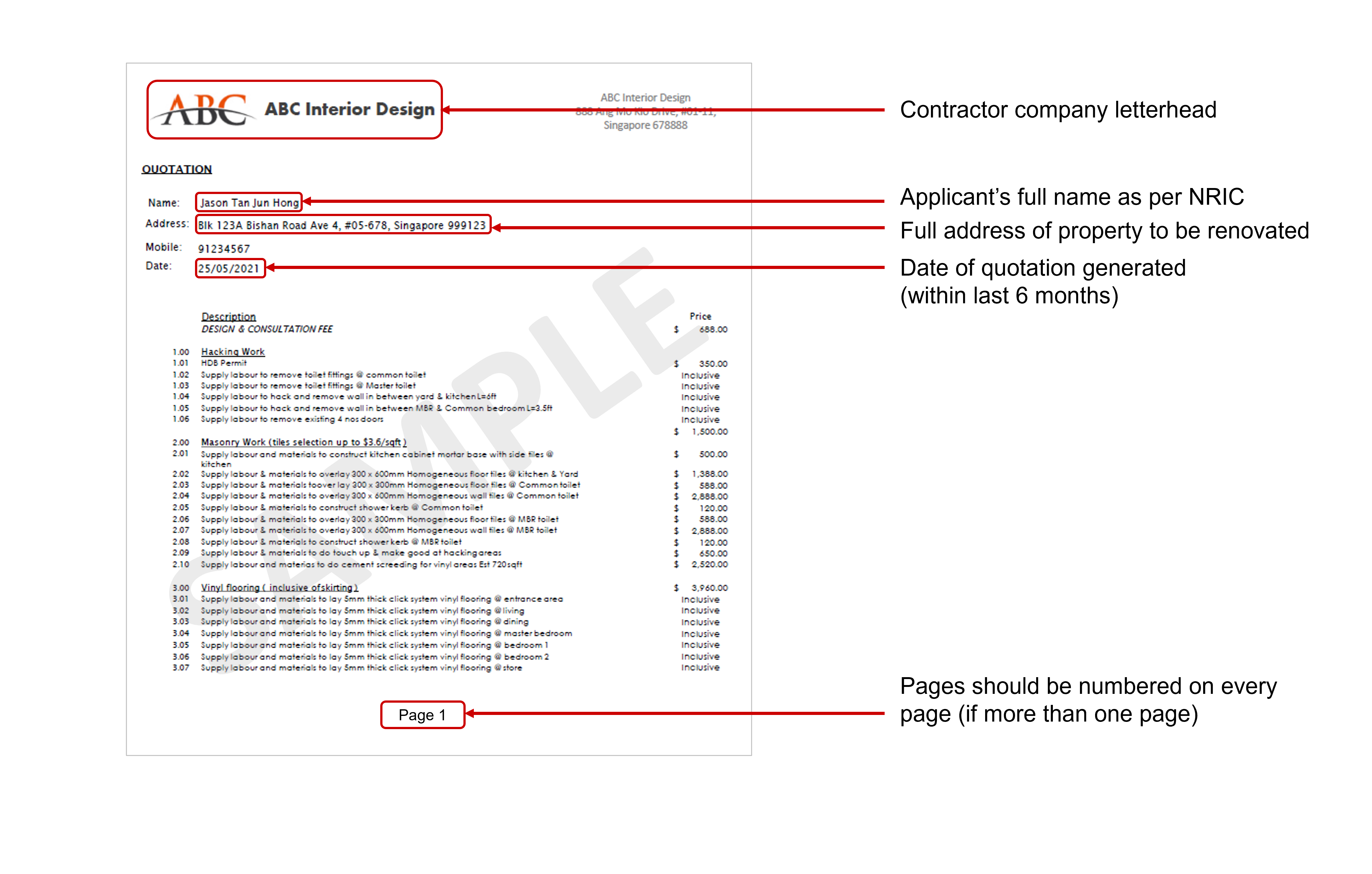

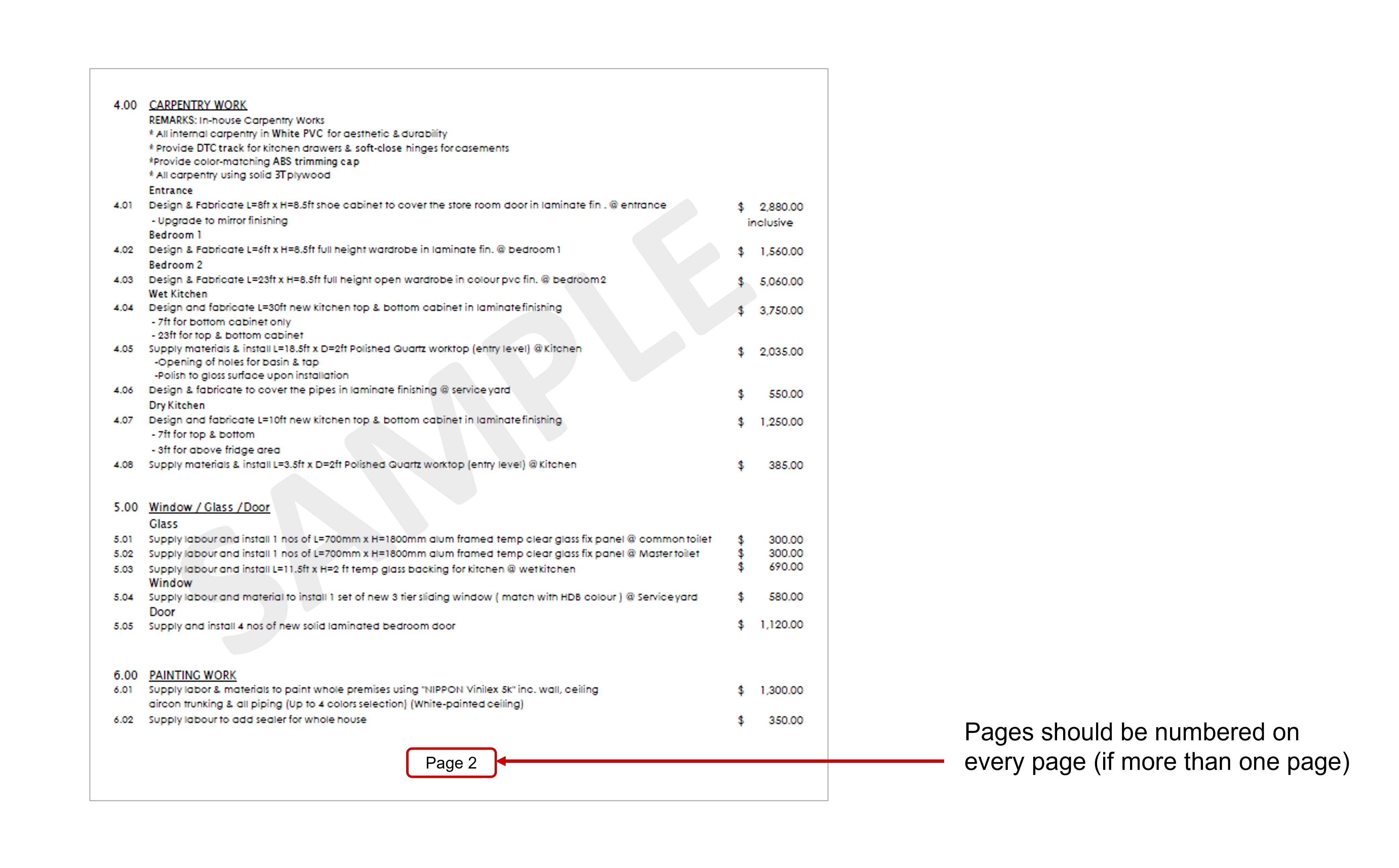

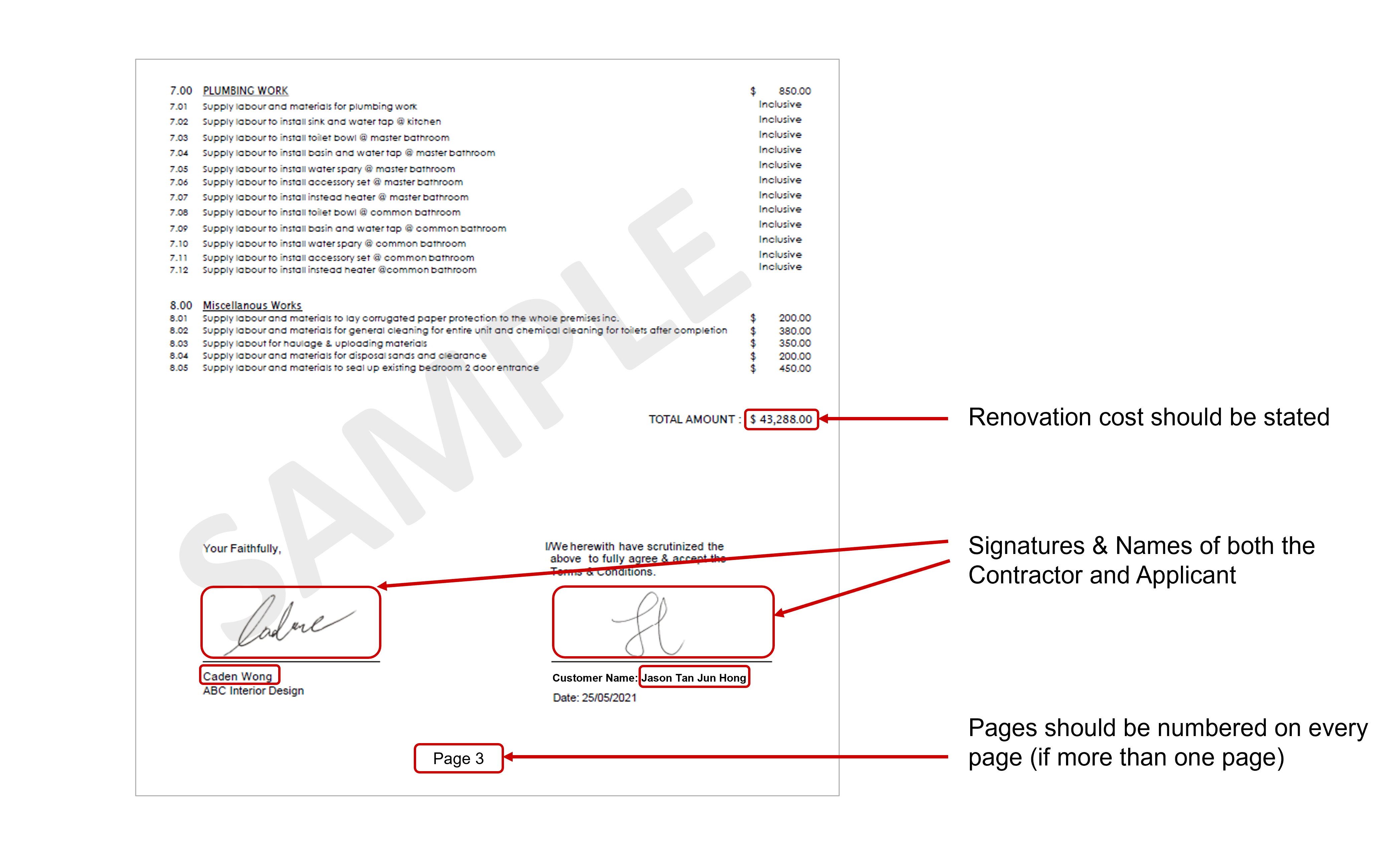

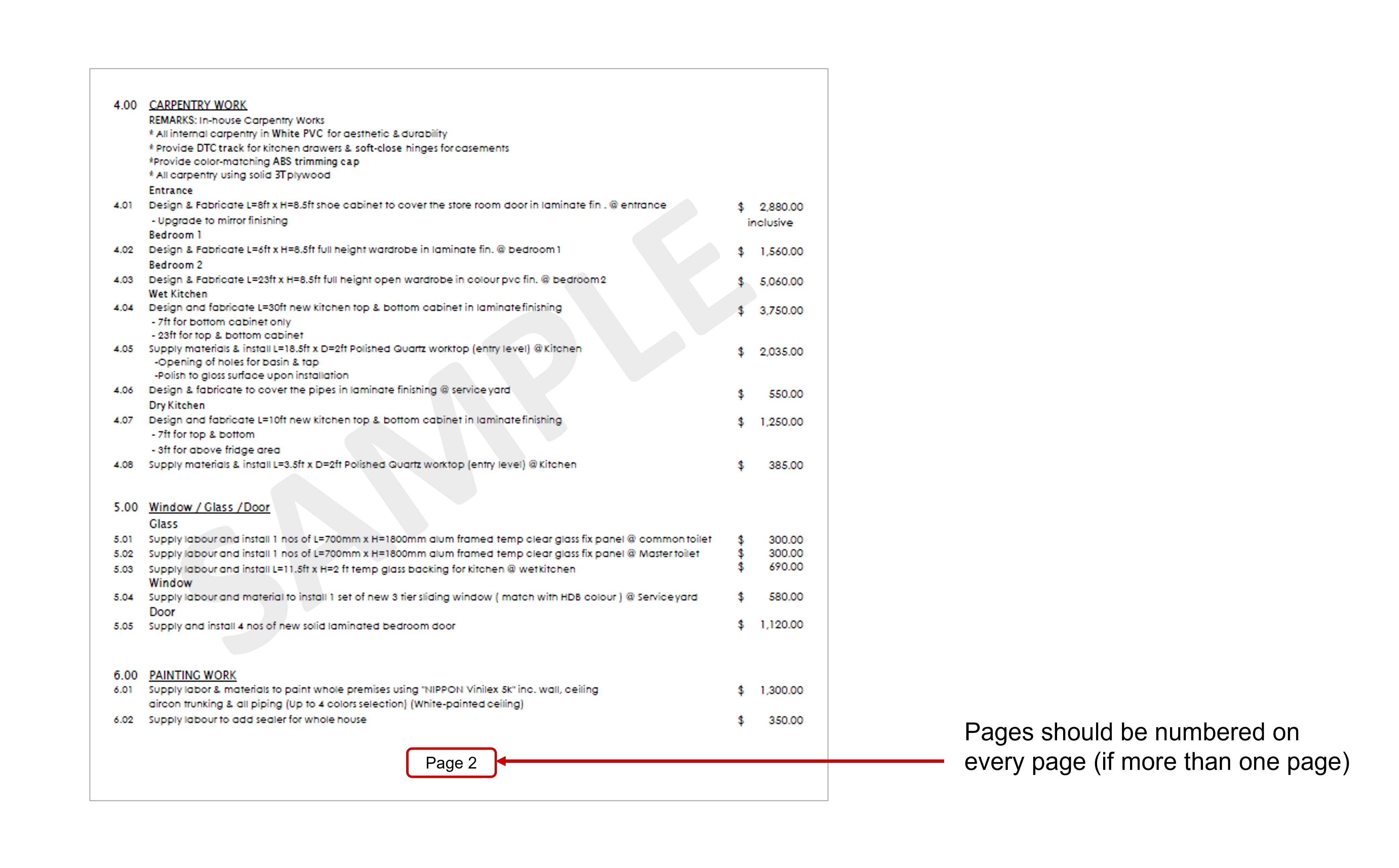

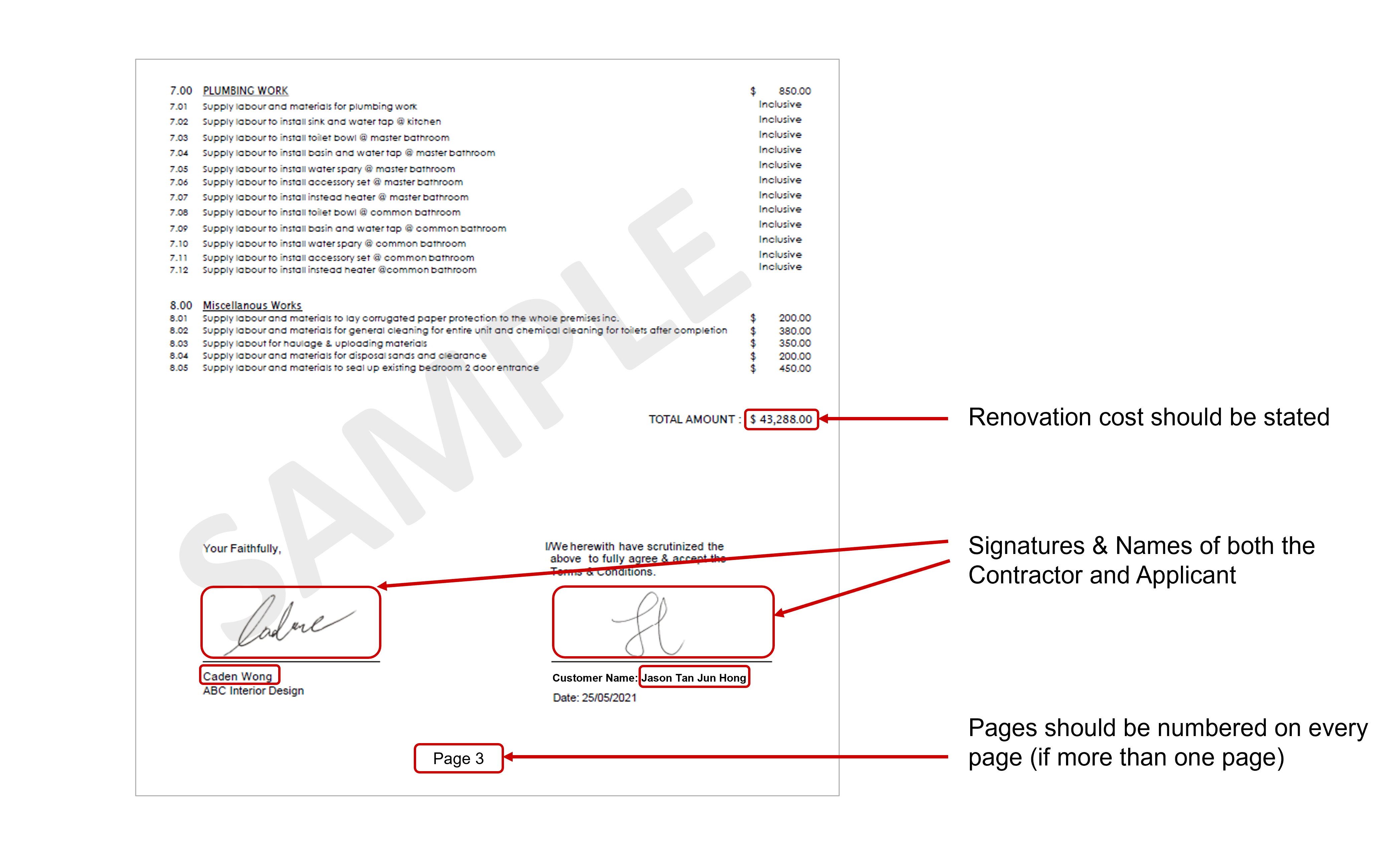

However, a renovation invoice/quotation is required to be submitted along with your application to show that the loan is to be used for home renovation works.

Approved loan amount: S$10,000

Fees payable:

Handling Fee (2% of S$10,000) = S$200

Insurance Premium (1% of S$10,000) = S$100

Disbursed loan amount: S$9,700 (S$10,000 – S$200 – S$100)

You will receive a letter on the outcome of your renovation loan application at your mailing address within 5-7 working days if all documents submitted are in order.

The approved loan amount will be disbursed in cashier’s orders as indicated in the application.

If additional information or documentation is required, you will receive an email with the details.

We appreciate your patience if the processing time takes longer when there are additional follow-ups required.

The cashier’s orders will be issued under your appointed renovation contractor’s name. You may pass them to your renovation contractor progressively as per the agreed payment schedule in the renovation invoice.

To reduce your Renovation Loan amount, you may use the Service Request form to submit your request.

To increase your Renovation Loan amount, kindly submit a fresh application for the incremental loan amount (minimum S$5,000) using the application form and provide your latest renovation invoice and income documents.

The monthly repayment amount will be automatically deducted from your loan servicing account on the 1st working day of every month. Please ensure sufficient funds in your account to avoid incurring the late payment fees.

You can have a maximum of 2 renovation loans with DBS/POSB, as long as the total loan amount does not exceed S$30,000. Please note that this is also subjected to approval based on your credit eligibility.