Lois M. Collins is a special projects and family issues reporter at Deseret News, including health, parenting and family policy.

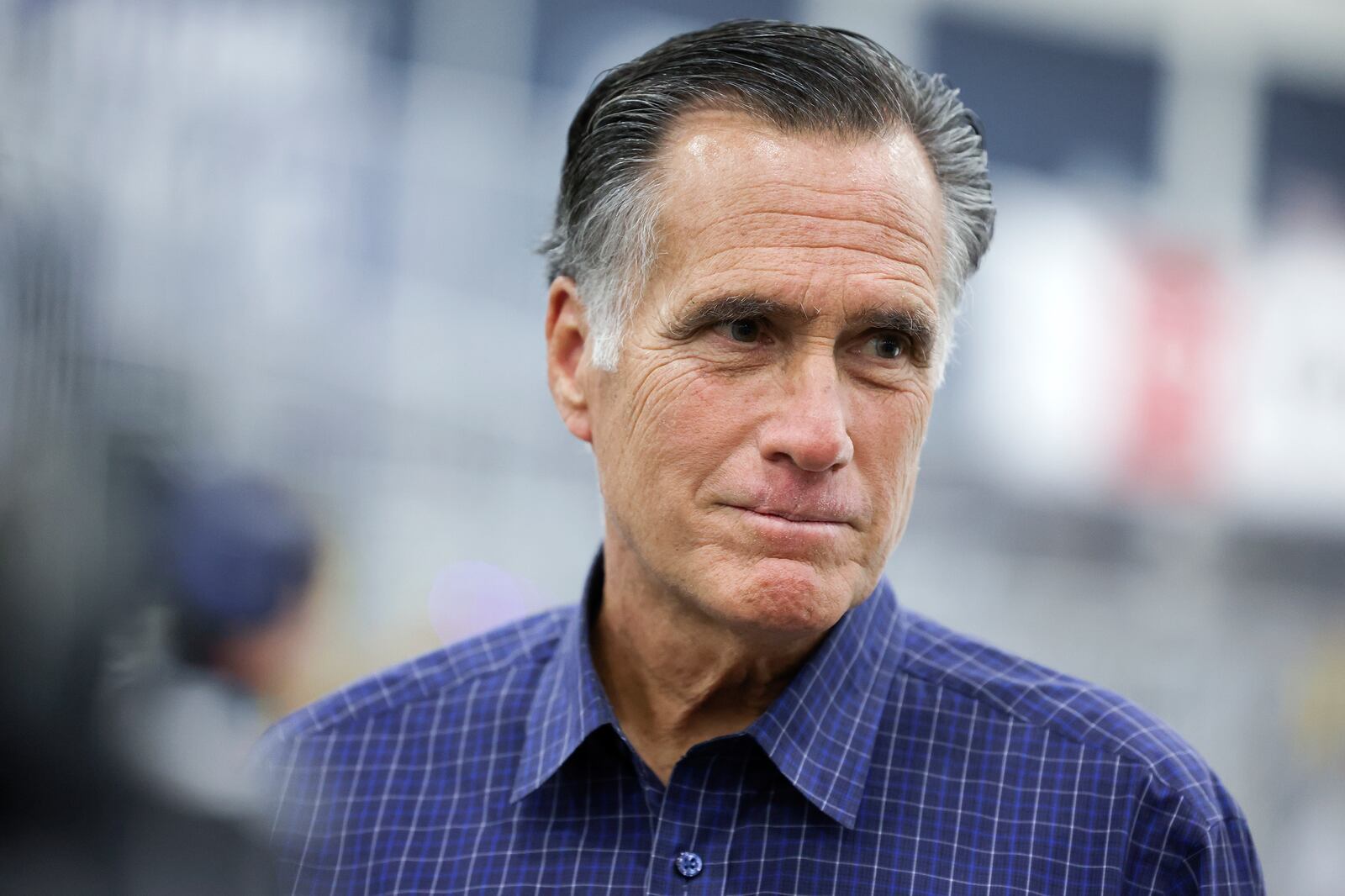

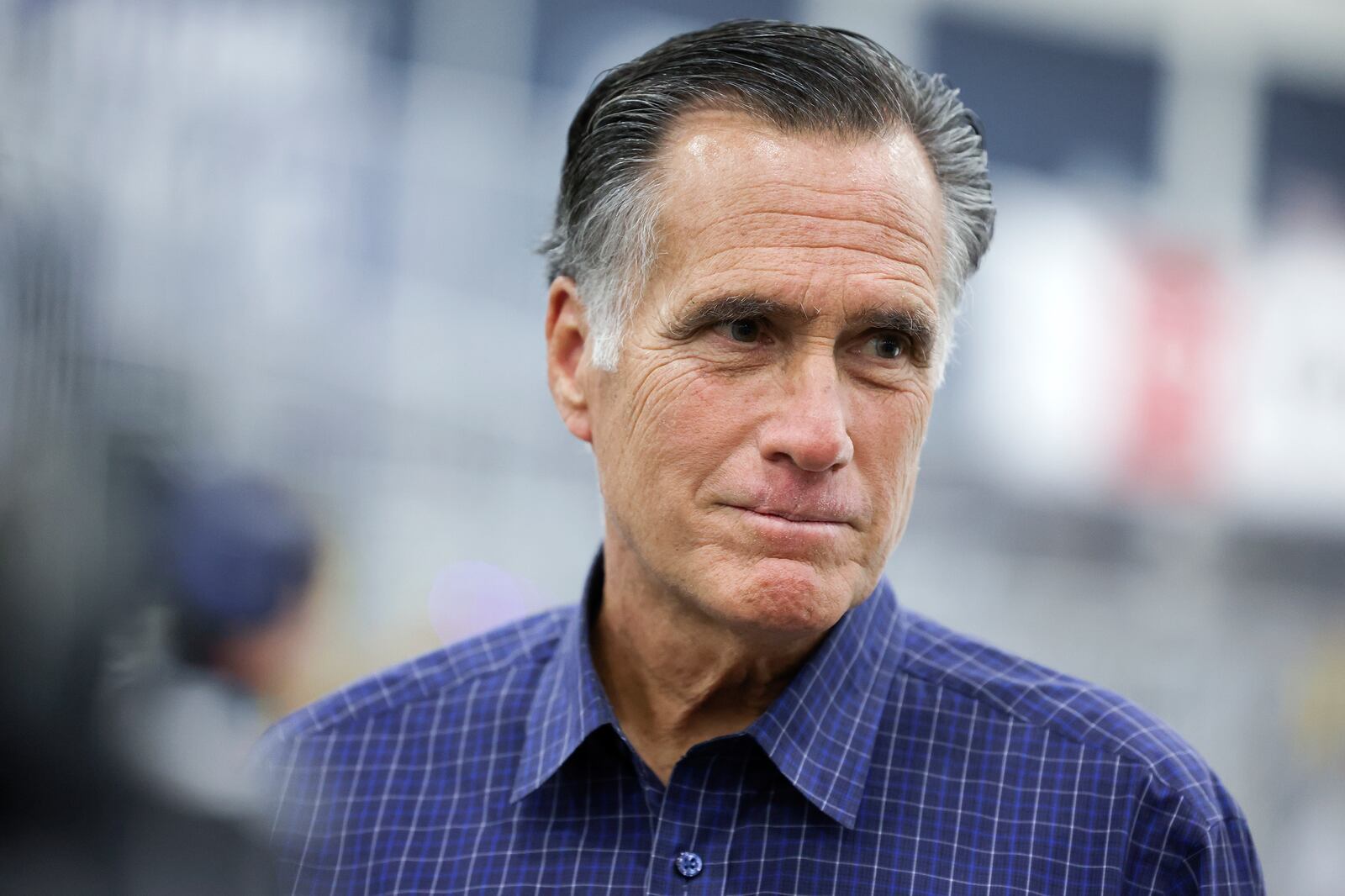

Sen. Mitt Romney’s child allowance plan has picked up a couple of co-sponsors and has been revised to emphasize work, provide help during pregnancy and ensure it doesn’t discourage marriage.

“The Family Security Act 2.0,” which the senator unveiled Wednesday morning, would provide parents with $350 a month for each young child and $250 a month for each school-age child 6 to 17. Additionally, pregnant women would qualify for up to four $700 payments during the last four months before their due date to help with the expenses associated with pregnancy and preparing for a newborn.

The bill includes a minimum earnings requirement, an income cap and a limit on the number of children for which parents could claim the benefit.

Like the version of the bill Romney, R-Utah, released on his own in February 2021, the act is designed to be cost neutral, so it shouldn’t exacerbate the inflation that many Americans have told pollsters is their top issue going into the midterm elections, his office said.

Romney’s updated plan is co-sponsored by Sen. Richard Burr, R-N.C., and Sen. Steve Daines, R-Mont. Policy advisers for Romney said the three senators together represent the spectrum of ideologies within the Republican Party, so the sponsors are hoping for “conference consensus.”

In separate prepared statements, the act’s three sponsors acknowledged that Americans are raising their families during a difficult time, highlighting high inflation and other challenges.

“Despite being the bedrock of our country, there’s perhaps never been a more challenging time than today to raise a family,” Romney said. “It’s no coincidence that fewer and fewer people are getting married and having children. We must do better to help families meet the challenges they face as they take on the most important work any of us will ever do: raising our society’s children.”

Burr referred to “unprecedented difficulties that have disrupted (families’) daily lives,” including the pandemic and school closures, as well as high inflation.

“These challenges made it clear that too many parents lack the financial and social support necessary to provide security for their children. Possibly even worse, many Americans want to start a family, but feel they simply can’t afford to,” he said, noting strong families are “essential to a healthy, stable society.”

The senators say the revised bill would help working families by:

“Our plan will ensure family policies are working for real families, while not adding to the national debt,” Daines said. “This framework will strengthen our commitment to help working American families grow and thrive, while also recognizing that the costs of a new baby begin even before that child is born.”

Under the act, a family would need to have earned at least $10,000 the previous year to receive the full benefit — an amount that would be indexed to inflation annually. Those earning less would get a proportional share based on what they did earn. Either or both parents combined could make the needed income, so one parent could stay at home with kids if the couple desired.

Romney’s policy advisers said that the earning requirement and other changes from the senator’s initial proposal are what colleagues told Romney they’d need to support the measure. Staff members also expressed hope the bill would attract support from Democrats, but noted that many senators across the aisle still hope to see the expanded child tax credit and monthly payments from the American Rescue Plan resuscitated.

“That hasn’t been our preferred route or the position of our conference,” a policy adviser said on background, expressing optimism that “more serious discussions” with Democrats around The Family Security Act 2.0 will take place once that effort plays out.

Romney’s bill would cap the number of children for whom benefits are paid at six. Parents could choose to receive the money monthly or as an annual lump sum.

In background material, Romney and his co-sponsors provided an example of how the proposal could work. Under current policies, they noted, a married couple with two children, ages 4 and 9, who earn a combined income of $38,990 — 150% of the federal poverty line — receive back $7,041 when they file their taxes. Under the Family Security Act 2.0, their benefit would increase to $9,359, and “they could receive over 75% of their total amount through predictable monthly installments.”

That amount includes the monthly child benefit of $600 a month and another $2,159 from the earned income tax credit that would be paid at tax time the following year.

The benefit would be administered by the Social Security Administration and available to parents with legal and physical custody. Those parents and the children they claim would each need to have a Social Security number.

Full benefits would phase out at $200,000 for single filers and $400,000 for joint filers, which is the existing child tax credit income cap. The payment reduces $50 for every $1,000 above those limits. Over- and underpayments would be reconciled at tax time through the Internal Revenue Service.

As part of the act, the earned income tax credit would be reformed to get rid of marriage penalties and promote work by slowing “benefit cliffs” at which households no longer qualify. The family portion would be consolidated so that it doesn’t vary depending on the number of dependents. And “the adult dependent component of the EITC would be separately maintained to ensure that no family earns less than the EITC in its current form,” according to a fact sheet provided by Romney’s office.

“This proposal proves that we can accomplish this without adding to the deficit or creating another new federal program without any reforms. I look forward to working with my colleagues in the coming months to continue improving this plan to best meet the needs of families across the country,” Romney said.

The benefits created by the bill are expected to cost just under $93 billion a year. To fund it, several changes would be made to existing policies and the money saved would be diverted to the cost of the Family Security Act 2.0.

The state and local tax deduction, often referred to as SALT, would be eliminated, saving just over $25 billion that would be diverted. Earned income tax credit reform would save $46.5 billion. Dropping the head of household filing status would save another $16.5 billion. And the final $4.7 billion would come from eliminating the child portion of the child and dependent care credit, the senators said.

Romney’s policy advisers told reporters that the head of household filing status is a “really regressive way to support families.”

While Romney’s office doesn’t have a dollar-amount projection of the act’s impact on poverty, advisers said it’s clear there would be a positive impact for working families, which is most families.

“I think there’s a misconception out there that all the families that are in poverty are just not working and are completely absent from the workforce,” one of the policy advisers said. “And that’s simply not true. The vast majority of them are working and we’re ensuring that they are going to get support through this plan.”

For families that aren’t now working, he added, “We’re setting a really attainable target to get that maximum benefit.”